What Are the Risks of Trading Futures Options?

Understanding the Risks of Trading Futures Options

Futures options are dextrous financial 해외선물 tools that allow traders to hedge their bets on the future price of a currency, commodity, or stock index – potentially offering great rewards but with significant risks. Knowing these can help avaricious investors harness profit opportunities while protecting against losses.

Leverage Risks

One of the most significant risks of trading futures 선물옵션 options is leverage. Futures options can offer traders substantial leverage, allowing them to amplify their gains when the trade moves in their favor. However, this increased potential for reward also carries a higher risk; significant losses may ensue if the underlying asset moves against expectations.

For example, By investing in a futures option contract, traders can experience an opportunity of potential reward; however, the risk is just as great. For every $1,000 invested into such a contract and assuming an underlying asset moves 10%, their position will be worth either $1,100 or down to only $900 depending on which direction it moved – this means that gains are up for grabs but so too could there be losses of up to 10%.

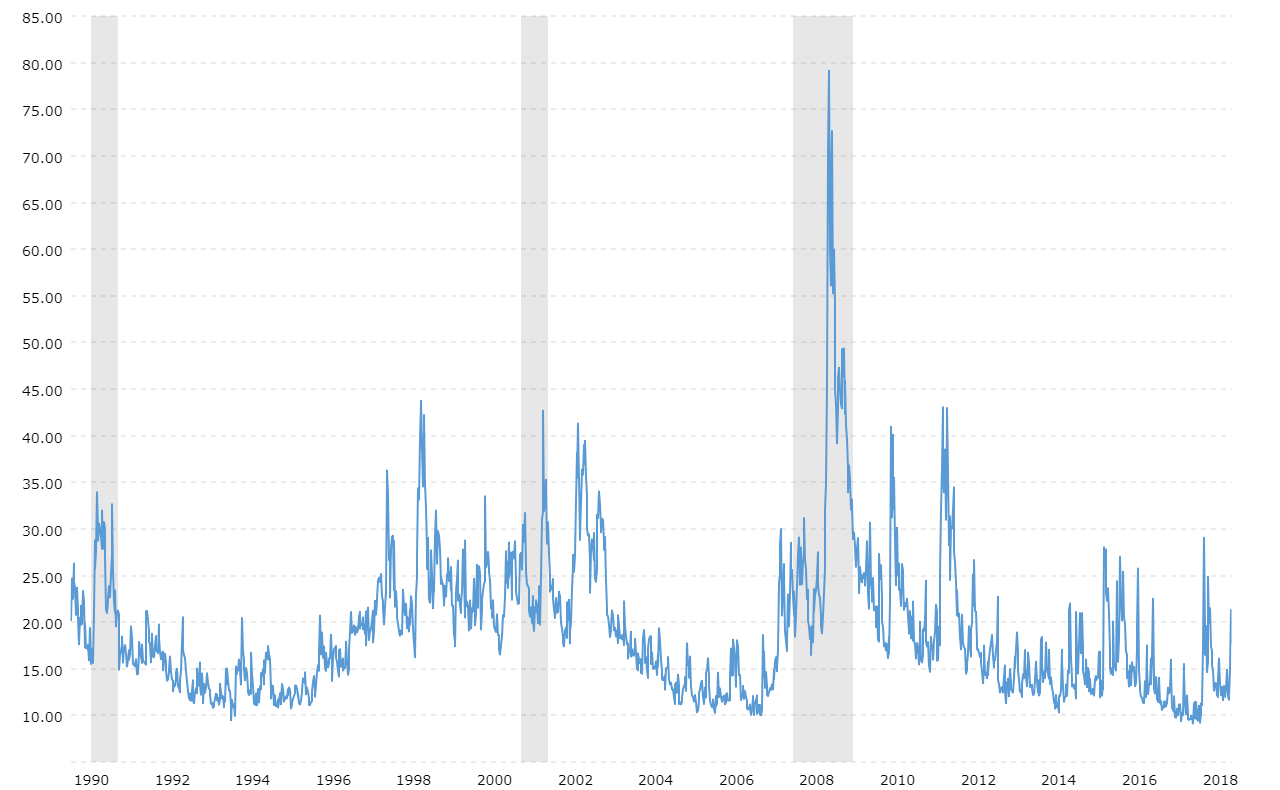

Market Risks

Trading futures options is not without its risks – chief among them being market risk. With prices determined by the underlying asset’s value, vast fluctuations can occur due to a variety of external factors; including economic data releases and political events or natural disasters – all these elements add an unpredictable edge when entering into this type of investment activity.

Savvy traders understand the importance of taking precautions against volatile market conditions. Stop-loss orders can help reduce losses but must be placed strategically to avoid false triggers due to short-term movements that might result in missed opportunities if not closely monitored.

Execution Risks

Execution risks are another concern for futures options 해외선물커뮤니티 traders. These risks refer to the potential for errors or delays in executing trades. Such errors can be caused by technical issues, such as internet connectivity problems or platform malfunctions, or human errors, such as entering the wrong trade size or price.

To ensure a successful trading experience and reduce potential risks, traders should equip themselves with the necessary tools. Making sure you have a dependable internet connection, utilizing an established trading platform, and confirming all requisites before submitting orders are key steps to mitigate any missteps that could occur during execution.

Counterparty Risks

When trading futures options, traders must trust their 해선대여계좌 funds and positions to a third-party Futures Commission Merchant (FCM). However, they should bear in mind that if this FCM becomes financially untenable or unable to meet its obligations, it could put the trader’s investments at risk.

To ensure a safe trading environment and mitigate risks, it’s essential that traders select an FCM with sound financial standing and an excellent reputation. Staying apprised of their margin requirements is paramount to guarantee the necessary funds are available for successful trades.

Tips for Managing Risks

Trading futures options can be a risky endeavor, but savvy traders recognize how important proper risk management is to secure lasting success. To help keep your investments secure, here are some essential tips:

- Use a disciplined trading approach: a well-thought strategy that outlines entry and exit points, stop-loss orders, as well as risk management measures. Creating such a plan can help traders maximize potential returns while limiting their chances of losses.

- Manage leverage: Trading should be approached judiciously, employing leverage to advantage and avoiding risks that outstrip one’s account size.

- Diversify: To minimize risk and maximize profits, traders should diversify their trading by leveraging multiple markets with a variety of strategies.

- Stay informed: traders should stay abreast of market news and events that may affect their positions. This includes keeping tabs on economic data releases, political advancements, and weather reports to ensure timely decision-making in volatile markets.

- Practice risk management: Traders should leverage risk management strategies – such as stop-loss orders, position sizing, and trailing stops – to limit potential losses while preserving profits.

Conclusion

Trading futures options 해외선물사이트 can offer lucrative results, but it is important to understand the associated risks and invest in measures for managing them. Leverage exposure, market conditions, order execution accuracy, and counterparty reliability should be considered when strategizing risk management techniques such as disciplined trading habits, leveraging control tactics, and portfolio diversification steps followed by an appropriate action plan based on staying well-informed.

Thriving as a futures options trader can bring considerable monetary rewards when approached with diligence, attention to detail, and vigilant risk management. Using the guidance provided in this article gives aspiring traders an advantageous starting point on their path toward financial success.